Expert Networks

Manage your expert network workflow

As use of experts (and sheer number of expert networks) continues to grow, ensure you manage your risk workflow comprehensively and efficiently.

Understand the SEC’s latest EXAMS assessment of expert network risk

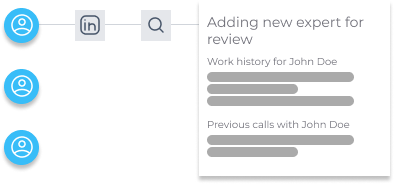

Centralized expert submission

Expert networks and investment teams can input expert information, supported by Modern Diligence’s automation which can fill in work history and conduct KYC and AML checks.

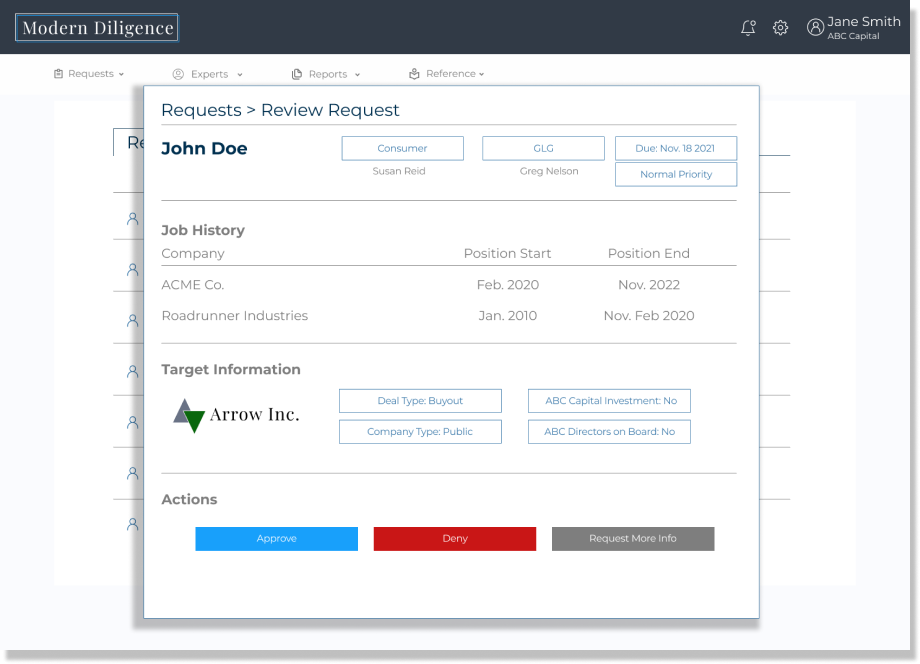

Queueing and review

Compliance officers can see the full approval queue across their firm in one place. Reviews can be conducted with all relevant information in a single window, including the expert’s work history, employment at target company, and number of calls conducted with the firm in the past year, all alongside relevant target information. Compliance officers can request call agendas from the deal team and review them once submitted all in the same portal.

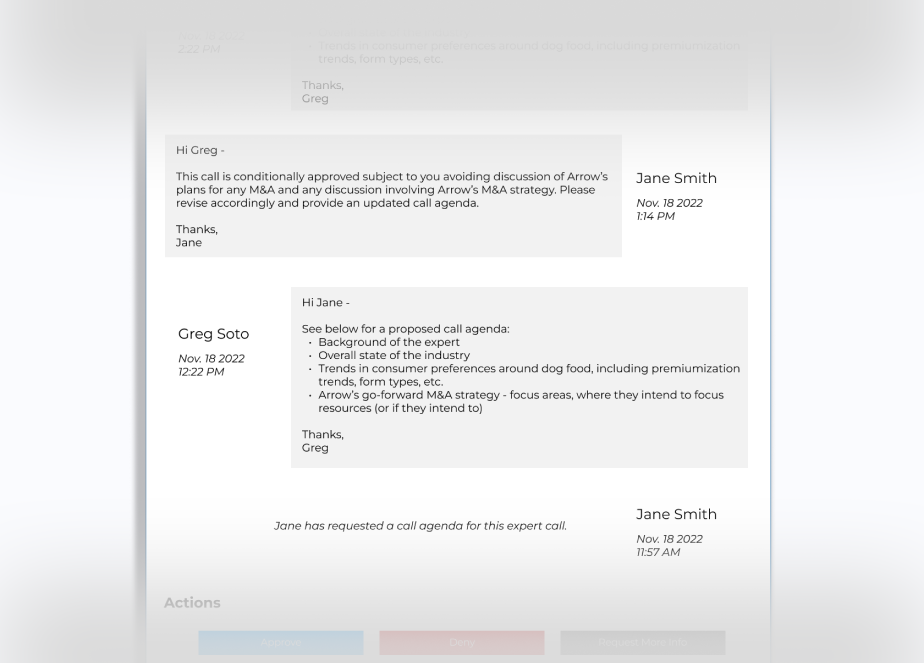

Centralized communication

Send emails directly via the Modern Diligence portal. Approve calls, request call agendas, and ask for more information without leaving the browser. Limit unnecessary emails and comprehensively track all expert-related communications.

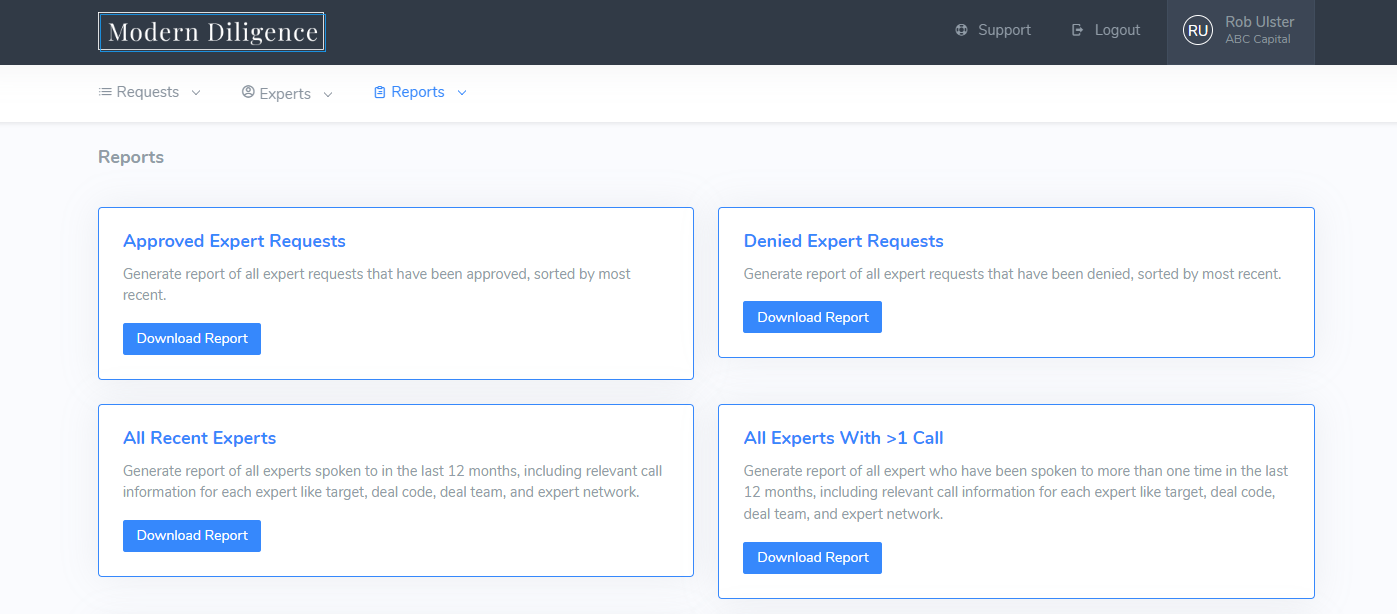

Detailed tracking and reporting

Modern Diligence serves as your firms source and record of all expert-related communication and review. Monitor the approval queue, conduct detailed tracking, and create ad hoc reporting, all with the click of a button, across all networks and investing teams.